Solar Panel Installation

Tesla Electrical and Solar are Electricians, solar designers and installers with 25 years of electrical experience.

We service the Northern Rivers and Gold Coast regions and are based in Kingscliff.

Our service areas include Casuarina, Cabarita, Pottsville, Tweed Heads, Murwillumbah and Palm Beach, also servicing from Ballina and Byron Bay to Brisbane.

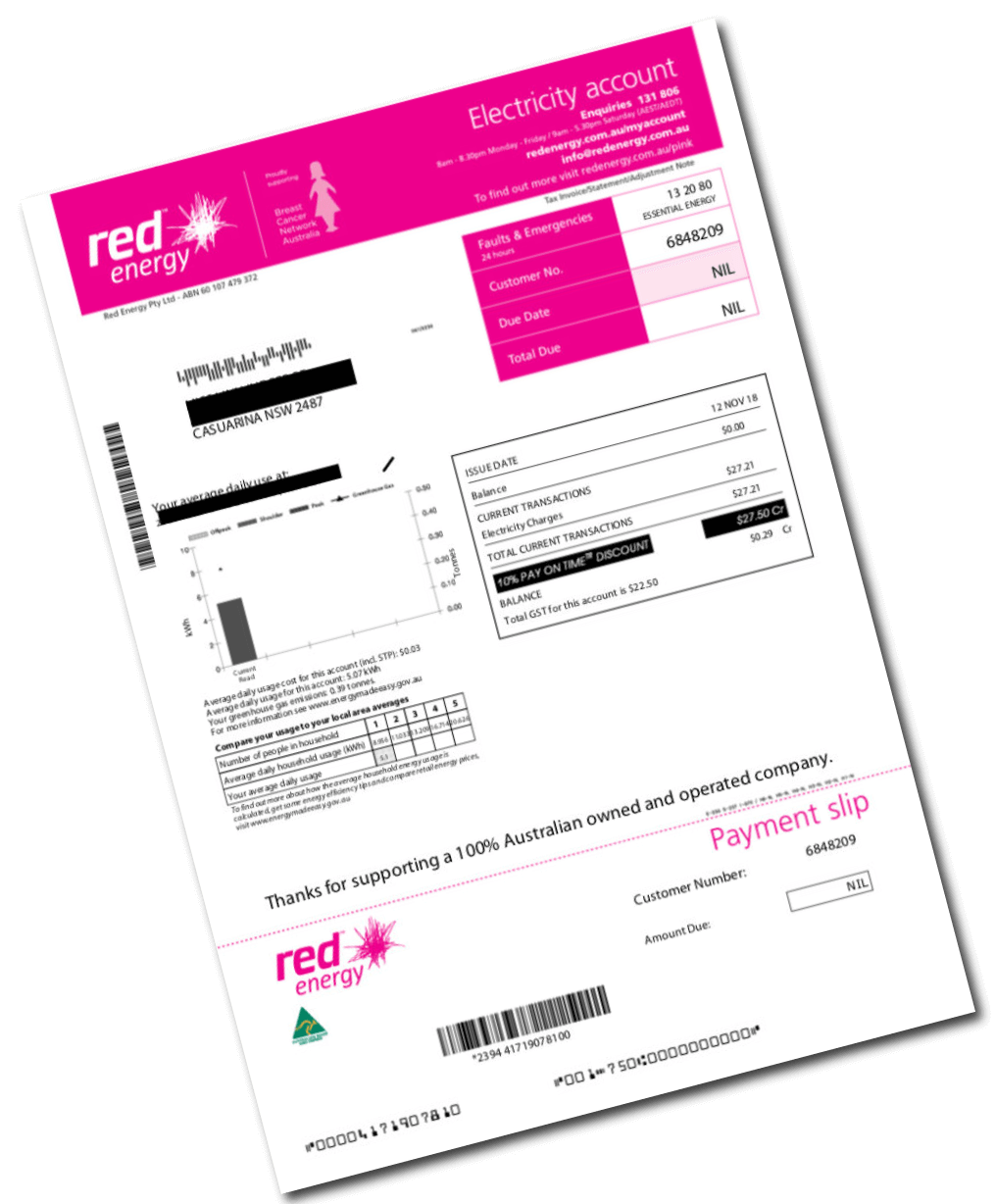

Tesla Electrical place an emphasis on getting amazing results for our ongoing customers and offering great service and support. We highly recommend using Enphase or Fronius Inverters when Investing in solar power. We aim for you to pay as little for electricity as possible, a lot of the time cancelling out your electricity bills.

Great product, service and support will guarantee great results.

Products we Offer

More about us

Save with a Solar Panel Installation

We are trusted, Environmentally Conscious Electricians with over 20 years Industry experience from Queensland to Northern NSW. Speak to any of our ongoing satisfied customers and let us show you results from any of our system Installations. We also have great customer testimonials as a direct result of our high quality product, service and support.

Tesla Electrical & Solar have taken all of the hard work out of Installing Solar, knowing what works best to get the right results for our clients and The Environment. Any dealing with our customers are viewed as ongoing relationships ensuring that your Electricity bills are minimal and remain this way. We have high quality Solar solutions for different types of system Installations. With results like ours everyone can afford solar.

We are ethical Electricians who deal with the entire solar process. We care about getting the right results for our customers and the Environment.

Enquire Now

Why choose Tesla Electrical & Solar?

Electrical

Our team of licensed electricians are experienced in all aspects of electrical work. We offer a prompt, professional and guaranteed service with an emphasis on safety – no job is too big or too small for us.

Find Out MoreSolar

Tesla Electrical can show you how you will receive return on your solar system within three years in a Victorian residential property (without factoring in the rising cost of electricity.

Find Out MoreCommercial Solar

Exceed the standards of your competitors and increase your appeal to potential clients by looking ahead and moving forward with the way of the future.

Find Out MoreMake an Enquiry

At Tesla Electrical & Solar we are proud to offer our clients the best in service, products and trusted advice. When you contact us, you can be assured you are dealing with qualified professionals, that will only give you advice that is best for your requirements.